Sustainable Investing: Engaging Global Stakeholders

- IPF Staff

- Nov 25, 2019

- 3 min read

Updated: Dec 7, 2020

An expert panel discussion on ESG standards & best practices for integration, engagement and exclusion as well as the supportive regulatory & global capital landscape held at the Sustainable Investing 2019: UK-India Partnership Forum on 7 November 2019 at the Guildhall, City of London. Presentations included the latest developments in green, social & ESG bond markets by the panellists -

Chair: Lord Gadhia – Director, UK Government Investments

Howard Sherman – Executive Director, MSCI ESG Research

Oguzhan Karakas – Cambridge Judge Business School

Tatiana Boroditskaya – Director Emerging Market Credit, UBS

Lord Jitesh Gadhia is a British Indian investment banker and businessman and has been a Member of the House of Lords since September 2016. Lord Gadhia was previously Senior Managing Director at Blackstone based in London and has over 25 years' investment banking experience, having also held senior positions at Barclays Capital, ABN AMRO and Baring Brothers. He has advised on a wide range of high-profile M&A transactions across developed and emerging markets including some of the largest investment flows between UK and India.

Lord Gadhia opened the session and presentations making three observations echoing the sentiments made in the keynote session. Firstly, that Sustainable Investment is a secular megatrend that is here for good, reflected in the assets under management of ESG related funds, that the trend reflects a broader shift from shareholder to stakeholder primacy emphasising people, planet as well as profit. Finally, that the issue of measuring impact beyond profit is one of the main challenges facing the industry.

Presentations by the panelists followed -

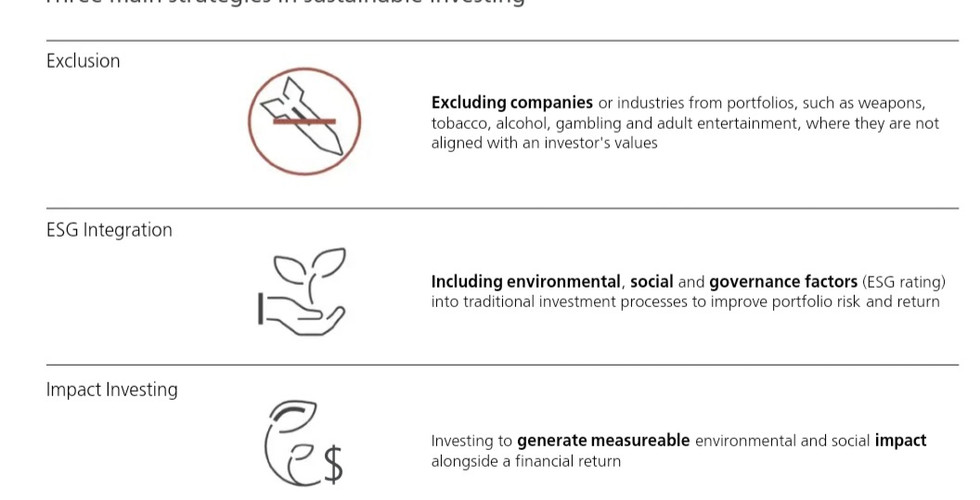

Tatiana Boroditskaya - UBS Wealth Management First to present was Tatiana Boroditskaya covering an introduction to the terminology and concepts of Sustainable Investing.

Tatiana has over 11 years of investment experience, covering CEEMEA corporate credit across a number of markets, including Russia, Turkey and UAE. Tatiana is a part of Emerging Market Investment team at Chief Investment Office, and is responsible for coverage of financials, oil and gas, metals and mining, transportation, industrials and telecom sectors.

Prior to joining the Chief Investment Office in 2013, Tatiana has worked as a analyst in the Emerging Markets Credit Research at UBS investment Bank for over four years. In this capacity, she covered financials and corporates in a number of CEEMEA markets. Tatiana holds a PhD in Economics and MSc in International Business from the University of Lancaster.

Followed by a keynote address by Oguzhan Karakas, Senior Lecturer at Cambridge Judge Business School on Responsible Investing, presenting the motivation of ESG investing - the fundamental problems and their proposed solutions. Oğuzhan Karakaş is a University Senior Lecturer in Finance at the Cambridge Judge Business School (CJBS). He is also a Fellow of the Centre for Endowment Asset Management of CJBS, the Cambridge Endowment for Research in Finance of CJBS, and the J M Keynes Fellowship in Financial Economics. Oğuzhan was an Assistant Professor of Finance at the Carroll School of Management at Boston College prior to joining Cambridge Judge Business School. He received his PhD at London Business School, his MSE at Princeton University, and his BS at Middle East Technical University. He has served as a part- time consultant to a hedge fund on establishing trading strategies.

Howard Sherman - MSCI

Howard Sherman of MSCI concluded the presentations by providing an India context to ESG investing including its strategic importance and developments in corporate governance.

Howard is a member of the MSCI ESG Research product management team and is responsible for the firm’s corporate governance offerings.

He also serves as the commercial liaison for the ESG sales team in the Asia-Pacific region. Howard is a co-founder and former CEO of Governance Metrics International, which merged with The Corporate Library and Audit Integrity in 2010 to form GMI Ratings. GMI was in turn acquired by MSCI in 2014. Howard is also a founding member of the International Corporate Governance Network (ICGN) and the Network for Sustainable Financial Markets.

A panel debate featuring diverse questions on investment processes, issues of greenwashing as well as the scale and scope of ESG concluded the session.

Comments